Answer:

attached answer

Step-by-step explanation:

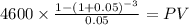

To build the amortization schedule we first needto know the issuance of the bond. Which will be determinate as the presetn value of the coupon payment and the maturity:

Coupon: 115,000 x 4% = 4,600.00

time 3 years

rate 0.05

PV $12,526.9409

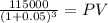

Maturity 115,000.00

time 3.00

rate 0.05

PV 99,341.32

PV c $12,526.9409

PV m $99,341.3238

Total $111,868.2648

Now, as the proceeds are lower than face value there is a discount for:

115,000- 111,868.27 = 3,132

Then we calculate the interest expense by multipling the carrying value by market rate:

111,868.27 x 5% = 5593.41

and the difference between the coupon payent is the amortization o nthe discount:

5,593.41 - 4,600 = 993.41

This is repeated for the next years until maturity.