Answer:

The answer is "Option a".

Step-by-step explanation:

Given:

FV=1.17

PV=1

n=4

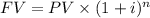

We are aware of a future value formula that is:

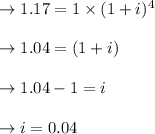

Put the value into the above formula:

Calculating the percentage of i= 4%

Therefore The rate of interest is equivalent to the inflation rate, which is projected predicted, according to global meta and experts, The Us will reach 5.70 percent even by conclusion of the this year. In the future, we anticipate that the inflation rate in the US is 3.20 in twelve months.