Answer:

The correct answer is "16.67%".

Step-by-step explanation:

Given:

Dividend,

= $100 billion

Rate of return,

= 10%

= 0.10

Growth rate,

= 5%

= 0.05

Now,

Market value will be:

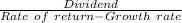

=

=

=

=

($)

($)

After collapse,

The market value will be:

=

=

=

($)

($)

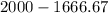

Change in market value will be:

=

=

($)

($)

hence,

The percentage change in market value will be:

=

=

%

%