Answer:

The answer is "148050 and 246740".

Step-by-step explanation:

Please find the complete question in the attached file.

for point a:

Cost

Less: Salvage value

Depreciable cost

Divide by Useful life

Annual Depreciation

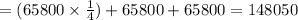

Depreciation expense

Accumulated Depreciation

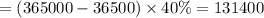

for point b:

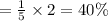

Double declining balance rate

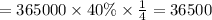

Depreciation for 2019

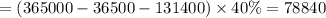

Depreciation for 2020

Depreciation expense for 2021

Depreciation expense 78840

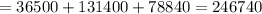

Accumulated Depreciation