Answer:

The right solution is "$966.27".

Step-by-step explanation:

Given values are:

Coupon rate,

= 10%

Par value,

= $1000

Yield of maturity,

= 12%

then,

Coupon will be:

=

=

=

($)

($)

Now,

The present value of coupon will be:

=

By putting the value, we get

=

=

=

=

($)

($)

The present value of par value will be:

=

=

=

($)

($)

hence,

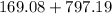

The price of bond will be:

=

=

=

($)

($)