Answer:

Step-by-step explanation:

From the question we are told that:

Initial cost

Annual benefits

Salvage value

Interest rate

Time

Generally the equation for Net Project worth X is mathematically given by

Where

Present worth of Annual benefits A is

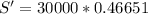

Present worth of Salvage Price S is

Therefore