Answer:

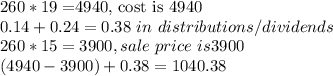

The ROI is 1040.38 with Distributions and Dividends included if you sell it now.

Step-by-step explanation:

Hope this helped!

Edit: This answer doesn't account for any fees, since you didn't list any fees. The only mutual funds that I know of without fees are index funds run by big financial institutions.