Answer:

The answer is " Andrews ROE increases."

Step-by-step explanation:

Please find the complete question in the attached file.

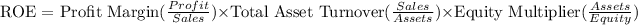

Using formula:

As total asset sales (sales/assets) decline whereas other items remain constant, ROE decreases. Or we could assume that growth of asset turnover would result in increased ROE, culminating in much more sales per unit of asset held by the firm.