Answer:

A. Interest Expense divided by Average Interest-bearing Debt

Step-by-step explanation:

A bond can be defined as a debt or fixed investment security, in which a bondholder (investor or creditor) loans an amount of money to the bond issuer (government or corporations) for a specific period of time. The bond issuer are expected to return the principal (face value) at maturity with an agreed upon interest (coupon), which are paid at fixed intervals.

An interest-rate risk can be defined as the risk associated with bond owners due to fluctuating interest rates. This risk has a direct level of impact on the value of fixed income securities such as bonds.

An interest rate can be defined as an amount of money that is charged as a percentage of the total amount borrowed from an individual or a financial institution.

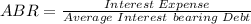

Mathematically, the average borrowing rate (ABR) for an interest bearing debt is calculated using the formula;