Answer:

The right answer is "$14,400". A further solution is provided below.

Step-by-step explanation:

The given values are:

Ordinary income,

= 200,000

Maxwell's marginal rate,

= 35%

Melissa's marginal rate,

= 12%

Mark's marginal rate,

= 22%

Now,

Form transfer to Melissa, the savings will be:

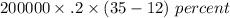

=

=

($)

($)

Form transfer to Mark, the savings will be:

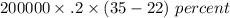

=

=

($)

($)

hence,

The expected annual tax savings will be:

=

=

($)

($)