Solution :

The PV "perpetual" obligation of the firm =

= $ 12.5 million

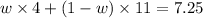

Also based on duration of the perpetuity, duration of this obligation =

= 7.25 years

Let

be the

be the

on the

on the

year maturity bond, which has a duration of

year maturity bond, which has a duration of

years. Then :

years. Then :

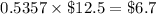

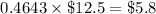

Therefore,

million in the

million in the

year bond

year bond

million in the

million in the

year bond.

year bond.

Therefore, the total invested amounts to $

million =

million =

million, which fully matches the funding needs.

million, which fully matches the funding needs.