Answer:

Following are the responses to the given question:

Step-by-step explanation:

For question A:

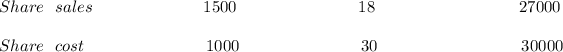

Particulars Numbers of shares price/share TotalAomunt

profit/Loss 0 -18000

For question B:

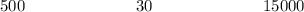

Remaining Share 500 30 15000

In this question, the average cost of the per share is 30/action, and when her fathers gave her 1000 stocks at 60 and the company then gave

shares as a dividend.

shares as a dividend.