Answer:

Following are the solution to the given points:

Step-by-step explanation:

For point a:

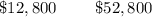

The total units to be accounted for

units

units

For point b:

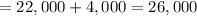

The total material equivalent units =

finished units

finished units

units

units

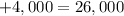

The total conversion equivalent units =

finished units +

finished units +

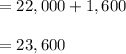

For point c:

Calculating the total cost reconciliation schedule:

Cost accounted for finished goods

Cost of material in the process

material work in process

conversion cost in the process