SOLUTION:

Step 1:

In this question,we have the following:

Step 2:

Part A: You want to buy a $ 175,000 and you have a $ 60,000 saved up.

The bank offers a 15-year mortgage at 3.2 % interest.

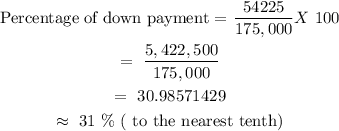

a) If you expect to pay $ 5,775 in closing costs. What percentage down payment can you afford? Round your answer to the nearest tenth of a percent.

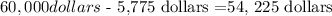

If you saved up $60, 000 and the closing costs is $ 5,775

The difference will be:

Part B :

If you put less than 20% down, you'll need to pay mortgage insurance.

Will you require mortgage insurance? YES or NO

The answer is NO because 31% is far more than 20%

Part C:

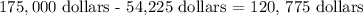

What will be the principal be on the loan?

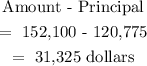

The principal on the loan =

Part D:

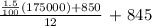

What will be your monthly P & I (principal and interest) payment be?

Part E:

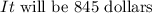

In addition to principal and interest, the property taxes will be 1.5 % of the home value per year, the house owners insurance will be $850 per year and the mortgage insurance. What will your total monthly amount be?

Part F:

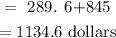

How much will you pay in total over 15 years in principal and interest?

Part G:

How much interest will you pay in total?