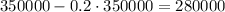

Our plan is to buy a house of $350,000 and we will make a 20% down payment.

So the mortgage of the house will be of:

A)

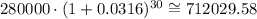

1) The cost of the first mortgage at a 30-year fixed mortgage at 3.16% is:

And the total of monthly payments is: 12*30 = 360

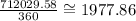

If we divide the total mortgage by the total number of payments we obtain that each payment is of:

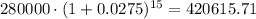

2) The cost of the second mortgage at a 15-year fixed mortgage at 2.75% is:

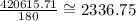

And the total of monthly payments is: 12*15 = 180

If we divide the total mortgage by the total number of payments we obtain that each payment is of:

A1) The first mortgage will give us the lowest monthly payment.

A2) The payment will be of $1977.86 per month.

A3) The paynment is: $2336.75 - $1977.86 = $358.89 less than the second mortgage.

B)

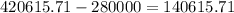

1) The interest of the first mortgage is:

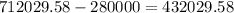

2) The interest of the second mortgage is:

B) The first mortgage will result us in paying the most interest and the interest will be of $432029.58