EXPLANATION

Given the equation:

x^3 -2x^2 -5x + 10 = 0

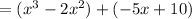

Grouping terms:

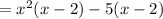

Factor out -5 from (-5x+10) and x^2 from (x^3-2x^2):

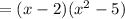

Factor out common term x-2:

Factor x^2-5:

![x^2-5=x^2-(\sqrt[]{5})^2](https://img.qammunity.org/2023/formulas/mathematics/college/dl48g6op2wjm96dppne5pdjgn0kdyqyfay.png)

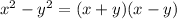

Apply difference of two squares formula:

![x^2-(\sqrt[]{5})^2=(x+\sqrt[]{5})(x-\sqrt[]{5})](https://img.qammunity.org/2023/formulas/mathematics/college/sfx4f4dd2v2qlxjiocptj6zntwygluvgbl.png)

Grouping factor:

![=(x-2)(x+\sqrt[]{5})(x-\sqrt[]{5})](https://img.qammunity.org/2023/formulas/mathematics/college/luryrk9ij8clng9lrz7wrk2dxdd2ytxdia.png)

Equaling to zero in order to get the roots:

![(x-2)(x+\sqrt[]{5})(x-\sqrt[]{5})=0](https://img.qammunity.org/2023/formulas/mathematics/college/lnlakhgh2fxdawhzuce4a8py3ot1y3cubw.png)

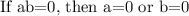

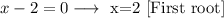

Using the zero factor principle:

![x+\sqrt[]{5}=0\longrightarrow\text{ x=-}\sqrt[]{5}\text{ \lbrack{}Second root\rbrack}](https://img.qammunity.org/2023/formulas/mathematics/college/d1najztxtveoy9k0u7oloukufy6j78ngch.png)

![x-\sqrt[]{5}=0\longrightarrow\text{ x=}\sqrt[]{5}\lbrack Third\text{ Root\rbrack}](https://img.qammunity.org/2023/formulas/mathematics/college/pmpqlhppvsog9mj1tvtmsrafzlup8hpw94.png)

The roots are:

x=2, x=-sqrt(5) and x=sqrt(5)