Given:

Piston 1 has an area

and the force applied on this piston is

The force on piston 2, which is the weight of the car, is

Required: The area of piston 2.

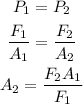

Step-by-step explanation:

The formula that can be obtained by balancing the pressures is

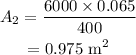

On substituting the values, the area of the second piston will be

Final Answer: The area of the piston lifting the car is 0.975 meter-squared.