Answer:

$9,330.35

Step-by-step explanation:

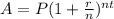

We'll use the below compound interest formula to solve the problem;

Where A = the future amount = $11,000

P = the starting amount(the principal)

r = the interest rate in decimal = 5.5% = 5.5/100 = 0.055

n = number of compounding periods = 12

t = time periods = 3 years

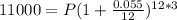

So let's go ahead and substitute the above values into our equation;

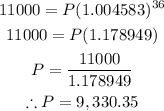

We can then evaluate and find P;

So the amount that should be deposited is $9,330.35