ANSWER

Step-by-step explanation

To find the amount of heat flow, we have to apply the equation for conduction rate through a wall:

where k = thermal conductivity of the material

A = area of surface

ΔT = T₂ - T₁ = Outer temperature - inner temperature

t = amount of time (in seconds)

L = thickness of wall

From the question, we have that:

![\begin{gathered} k=0.75\text{ W\backslash{}m}\degree C \\ A=2.7\cdot11=29.7m^2 \\ \Delta T=30-7=23\degree C \\ t=17.5\cdot3600=63000\text{seconds} \\ L=7\operatorname{cm}=0.07m \end{gathered}]()

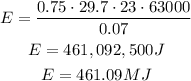

Therefore, the amount of heat that flows through the wall is: