The quadrilateral is a rectangle, all of its corner angles are rigth angles.

5)

m∠DAC=2x+4

m∠BAC=3x+1

Both angles are complementary, which means that they add up to 90º

You can symbolize this as:

Replace the expression with the given measures for both angles:

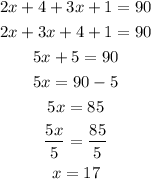

Now you have established a one unknown equation.

Solve for x:

Next is to calculate the measure of m∠BAC, replace the given expression with x=17

m∠BAC=3x+1= 3*17+1=52º

6)

m∠BDC=7x+1

m∠ADB=9x-7

Angle m∠BDC is a corner angle of the rectangle, as mentioned before, all corner angles of a rectangle measure 90º, so there is no need to make any calculations.

Note: the diagonals of the rectangle bisect each corner angle, this means that it cuts the angle in half, so m∠BDC=2*(m∠ADB)