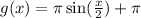

We have the next function

the amplitude is π

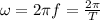

The natural frequency is

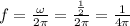

with this, we can calculate the frequency and the period

for frequency

the period is

The phase shift is 0

the vertical translation is π

the equation of midline is

The graph of the function is

where g(x) is the graph in red and the midline is the graph in blue