Answer:

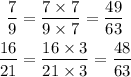

7/9 = 49/63

16/21 = 48/63

7/9 > 16/21

Step-by-step explanation:

First, we need to notice the following:

9 x 7 = 63

21 x 3 = 63

So, to get a common denominator, we will multiply the first fraction by 7 and the second fraction by 3, then:

So, the first part of the answer is

7/9 = 49/63

16/21 = 48/63

Now, the number with a greater numerator will be the greater. Since 49 is greater than 48, we get

7/9 > 16/21

So, the answers are:

7/9 = 49/63

16/21 = 48/63

7/9 > 16/21