Solution:

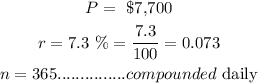

Given:

Part A:

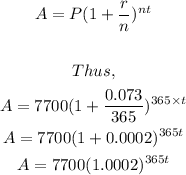

Using the compound interest formula,

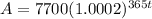

Therefore, the function showing the value of the account after t-years is:

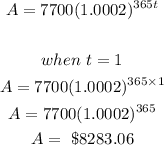

Part B:

To get the percentage growth per year, we get the amount in the account at the end of two successive years.

At the end of year 1:

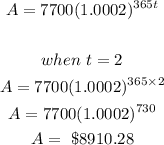

At the end of year 2:

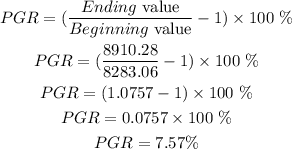

The percentage growth is gotten using the formula:

Therefore, the percentage of growth per year (APY) is 7.57%