Given:

A pound of popcorn is popped for a class party.

Each box holds 120 popped kernels.

There are 1450 kernels in a pound of unpopped popcorn.

All boxes are filled except for the last box

We will find the number of boxes, let the number of boxes = x

So, we can write the following equation:

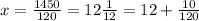

Solve the equation to find (x):

So, the answer will be option 2

There are 13 boxes, 12 of them filled and 10 popped kernels in the last box