The total income is $67,200.

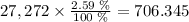

Then, the income between $0 and $27,272 is: $27,272 and the tax rate is 2.59%, then the amount is:

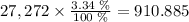

Now, the income between $27,272 and $54,544 is: 54544-27272= $27,272. And the tax rate is 3.34%, then the tax paid for this income is:

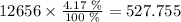

For the income between $54,544 and $163,632 the tax rate is 4.17%, in this part we only have: $67,200-$54,544=$12,656, then the tax paid for this income is:

Then, the total amount of tax paid is:

$706.345+$910.885+$527.755=$2144.99=$2145