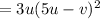

3u(5u-v)²

STEP - BY - STEP EXPLANATION

What to do?

Factor the given trinomials.

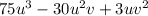

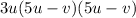

Given:

To solve, we will follow the steps below:

Step 1

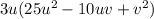

Factor out 3u from the given trinomials, since 3u is common to all the terms.

Step 2

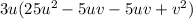

Further factorize 25u² - 10uv + v²

Step 3

Find two terms such that its product gives 25u²v² and its sum gives -10uv.

The two terms are -5uv and -5uv.

Step 4

Replace the -10uv by the two terms.

That is;

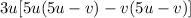

Step 4

Factorize the inner parenthesis.

Therefore, the factorized form is 3u(5u-v)²