Ok so first we are gonna calculate the tax bill for each town independently and then we are gonna add their values. The tax rate in Salinas is $1.96 per $100 of assessed value and we know Mr. Graham's property is assessed at $250000 so we can use the rule of three:

$100-----------$1.96

$250000----------x

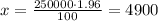

Where x represents his property tax bill for Salinas. According to the rule of three:

So he has to pay $4900 in taxes for that property. Now we make the same process for his property on Modesto:

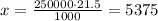

$1000-----------$21.5

$250000----------x

So he has to pay $5375 for his property in Modesto. Adding the two bills we know the total property bill: $4900 + $5375 = $10275