hello

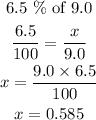

to solve this problem, we will first of all find 6.5% in $9.00

this would be the cost or rate of the tax

the cost of the tax is $0.585

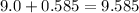

the total cost of the purchase is the sum of the cost of the chew toy plus the tax

Kane spent $9.585 in the store