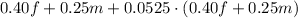

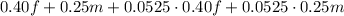

We have that we can represent the total cost before taxation as follows:

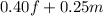

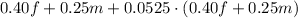

However, we need to add the tax to each of the items. We have that this amount is the 5.25% of each item. Then, we have:

n% = n/100

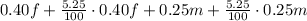

Then, we can continue as follows:

And

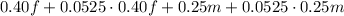

Therefore, the correct option is the last option: