ANSWER

Step-by-step explanation

The ratio of the tax to the value of the property is constant.

Let the amount of tax on the property assessed at $390,000 be x.

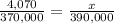

This implies that:

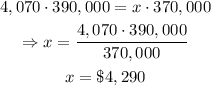

Solving for x, we have that:

That is the amount of tax on the property.