Let's begin by listing out the information given to us:

Items: $2.50, $8.75, $3.00 & $10.25

Tax = 6% = 0.06

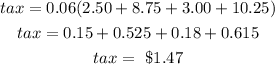

With Distribution, we have:

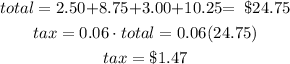

Without Distribution, we have:

I think it is easier without distribution. It gives less room for numerical inaccuracies