Answer:

$820.63

Step-by-step explanation:

For two different properties, we have the following:

• Assessed Value = $63,000

,

• Tax = $550

• Assessed Value = $94,000

,

• Tax = $x

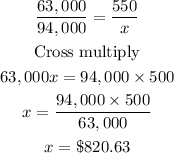

Using a proportion, we have:

The tax on a property with an assessed value of $94,000 is $820.63 (correct to 2 decimal places).