Answer:

$389,200

$21,200

Since,

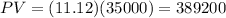

We are to find PV when the PMT is $35000. Since the PVA is 11.12,

Hence, Austin would need to deposit $389,200.

For the last part, we first need to solve the PV at 4% in 20 years.

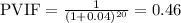

The PVIF would be:

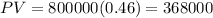

Then, solving for the PV:

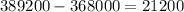

Now, to know how much more should Austin deposit, we need to subtract the original PV from the PV that we got from part B.

That would be,

Austin would need to deposit $21,200 more to achieve his withdrawal goal.