The breakdown of fees paid by the Caldwell family are calculated and shown below;

The total cost of the order will now be

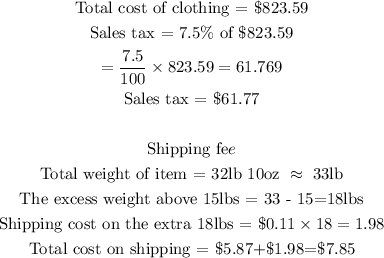

Total cost of clothing = $823.59

Shipping cost = $7.85

Sales tax = $61.77

TOTAL = $823.59 + $7.85 + $61.77 = $893.21

Therefore, the total cost of the order is $893.21