Answer:

The unfinished jobs are "$52,350".

Step-by-step explanation:

The given values are:

Work in process balance,

= $17,890

Direct material,

= $145,450

Direct labor,

= $156,900

Factory overhead,

= $82,470

The four finished jobs are:

Job 210,

= $72,490

Job 216,

= 44,300

Job 224,

= 84,570

Job 230,

= 149,000

Now,

According to the total of all four finished jobs:

The Journal entry will be:

Debit Credit

(a) Finished goods $350,360

Work in progress $

(b)

The unfinished jobs on January 31st will be:

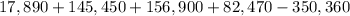

= Work in progress opening balance + Direct material + Direct labor + Factory overhead - finished goods

On substituting the values, we get

=

=

($)

($)