Answer:

Step-by-step explanation:

The question has a lot of confusing and unclear details. I will just answer the part that requests for the amount of tax to be paid by the single person given the taxable income of $65,725

Given

Status: Single

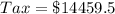

Required

Determine the tax amount

For a single person whose taxable income is within the range of $39,476 - $84,200, the tax is 22% of the taxable income.

So, we have: