Final answer:

To provide $11,600 in four years at an interest rate of 4%, you would need to set aside approximately $10,349.01 now. To cover $511,000 in school fees for the next five years at an interest rate of 7%, you would need to set aside approximately $2,045,531.32 today. After investing $555,000 at an interest rate of 7% and paying the school fees, there would be a deficit of approximately $1,490,531.32 at the end of five years.

Step-by-step explanation:

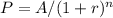

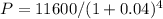

a. To calculate the amount needed to be set aside now to provide $11,600 in four years at an interest rate of 4%, we can use the formula for compound interest:

Where:

P is the present value

A is the future value

r is the interest rate

n is the number of periods

Plugging in the values:

P ≈ $10,349.01

Therefore, you would need to set aside approximately $10,349.01 now to provide $11,600 in four years.

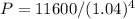

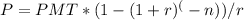

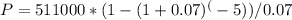

b. To calculate the amount needed to be set aside today to cover $511,000 in school fees for the next five years at an interest rate of 7%, we can use the formula for the present value of an ordinary annuity:

Where:

P is the present value

PMT is the annuity payment

r is the interest rate

n is the number of periods

Plugging in the values:

P ≈ $2,045,531.32

Therefore, you would need to set aside approximately $2,045,531.32 today to cover $511,000 in school fees for the next five years.

c. To calculate the amount that would remain at the end of five years after investing $555,000 at an interest rate of 7% and paying the above school fees, we can subtract the present value of the annuity (calculated in part b) from the initial investment:

Remaining amount = Initial investment - Present value of annuity

Remaining amount = $555,000 - $2,045,531.32

Remaining amount ≈ -$1,490,531.32

Therefore, assuming no additional income or expenses, there would be a deficit of approximately $1,490,531.32 at the end of five years.