Solution :

Item Amount

Income $113,000

Personal exemption for one $ 4,050

Standard deduction $ 6,350

Taxable income $102,600

Therefore the taxable income is $102,600.

Now the tax payable on the taxable income is given by :

Marginal tax rate Amount brackets

10% $0 - $ 9,325

15% $ 9,326 - $ 37,950

25% $ 37,951 -$ 91,900

28% $ 91,901 - $ 191,650

Now according to the above taxable slab, the amount of tax on the wages earned by Jenna is :

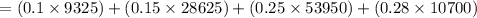

Tax payable =

= 932.5 + 4293.75 + 13487.50 + 2996

= $ 21,709.75

There is also a long term capital gain of $ 5,200 that is earned by selling the common stock.

Now as per IRS, the capital gain of a long term tax percentage for an individual single filer is in 28% tax slab category is 15%.

Therefore the tax on the capital gain of $ 5,200 is = 0.15 x 5200

= $780

Thus the total tax payable by Jenna is = $ 21,709.75 + $ 780

= $ 22,489.75