Answer:

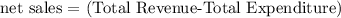

The answer is "$500".

Step-by-step explanation:

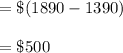

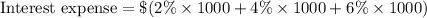

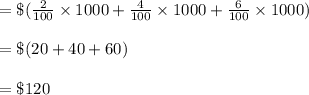

Calculating the total Interest Income:

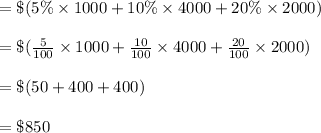

Profits of non-interest=$1000

Earnings and losses for shares = $40

For point 1:

The formula for Total Revenue:

For point 2:

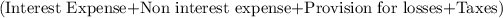

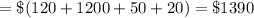

The formula for total Expenditure:

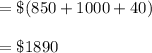

Expenditure for non-interest=$1200

Loan and damage provisions = $50

Tax = $20

Complete Expenditures

Therefore,