Answer:

Option A and option B applies

Explanation:

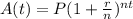

The compound interest formula is given by:

Where A(t) is the amount of money after t years, P is the principal(the initial sum of money), r is the interest rate(as a decimal value), n is the number of times that interest is compounded per year and t is the time in years for which the money is invested or borrowed.

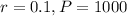

Marcus has opened a savings account where the yearly interest rate is 10%. He deposits $1,000 to start the account.

This means, respectively, that:

. So

. So

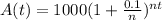

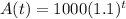

Option A:

. So

. So

So option A applies

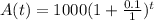

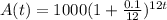

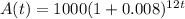

Option B:

. So

. So

0.1/12 = 0.008. So

So option B also applies.

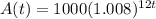

The other options will not apply.