Answer:

Option D.

Step-by-step explanation:

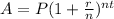

Formula for amount after compound interest:

where,

P is principal

r is rate of interest.

n is number of times interest compounded in one period.

t is number of periods.

Given information:

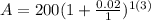

P = $200

r = 2%=0.02

t = 3

n= 1

Substitute these values in the above formula.

Keith have $212.24 in his account after three years.

Therefore, the correct option is D.