Answer:

Explanation:

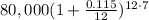

We have given:

Principal amount which is 80,000

Time which is 20 year

Rate which is 11.5%

And since, we have to find 13 years early so, time would be: 20-13=7 years.

And since, we have to find for 12 months

Hence, n=12

We have formula to calculate compound interest:

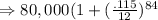

On substituting the values we get:

On simplification we get: