Answer:

He will save $ 63.61 ( approx ).

Explanation:

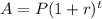

Since, the credit card balance formula,

Where,

P = Original balance

r = rate per period,

t = number of periods,

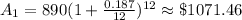

If P = $ 890,

Annual interest rate = 18.7% = 0.187 ⇒ monthly rate, r =

( ∵ 1 year = 12 months )

( ∵ 1 year = 12 months )

Number of years = 1 ⇒ months, t = 12,

Thus, the balance after year,

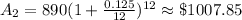

If Annual interest rate = 12.5% = 0.125 ⇒ monthly rate, r =

The balance would be,

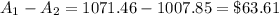

Since,

Hence, he will save $ 63.61 ( approx ).