Answer:

b. X and Z

Explanation:

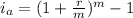

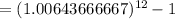

Since, the effective annual rate is,

Where r is the nominal rate per period,

m is the number of periods in a year,

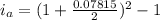

For loan X,

r = 7.815 % = 0.07815

m = 2,

Thus, the effective annual rate,

Since, 7.968\% < 8.000 %

Thus, Loan X meets his criteria.

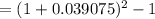

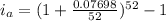

For loan Y,

r = 7.724%= 0.07724

m = 12,

Thus, the effective annual rate,

Since, 8.003 > 8.000 %

Thus, Loan Y does not meet his criteria.

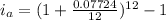

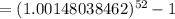

For loan Z,

r = 7.698% = 0.07698

m = 52,

Thus, the effective annual rate,

Since, 7.996 % < 8.000 %

Thus, Loan Z meets his criteria.

Hence, option 'b' is correct.