Answer:

b. X and Z

Explanation:

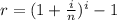

Since, the effective rate is,

Where, i is the nominal rate,

n is the number of compounding periods,

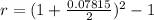

For loan X,

i = 7.815 % = 0.07815,

n = 2, ( 1 year = 2 semiannual )

Thus, the effective rate would be,

Since, 7.968 % < 8.000 %,

⇒ Loan X meets Mike's criteria,

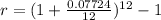

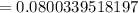

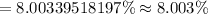

For loan Y,

i = 7.724 % = 0.07724,

n = 12 ( 1 year = 12 months ),

Thus, the effective rate would be,

Since, 8.003 % > 8.000 %,

⇒ Loan Y does not meet his criteria,

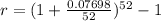

For loan Z,

i = 7.698 % = 0.07698,

n = 52 ( 1 year = 52 weeks ),

Thus, the effective rate would be,

Since, 7.996 % < 8.000 %,

⇒ Loan Z meets his criteria.

Therefore, Option 'b' is correct.