Given:Amortizing period = 5 years

APR=5% per annum

interest rate, i = 0.05/12 per month

number of periods, n = 5*12=60 months (for amortization)

Payment schedule:

$500 at the end of first month,

increased by $20 each month thereafter.

Borrowed amount: not given

Question: Find outstanding loan balance after the 40th payment.Solution:Step 1: First we need to find the amount borrowed, P.

From the payment schedule, we decompose the payment into two components,

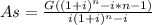

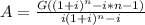

A. Equivalent uniform monthly payment, As, for a step amount of G=$20 a month, starting with zero after the first month, for a period of 5 years (n=60).

The value of As can be obtained from a specialized formula for step-payments,

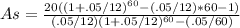

Substitute values, G=20,i=0.05/12,n=60

=565.0847

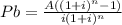

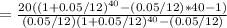

B. Principal, Pb, for a uniform monthly payment of A a month

The principal,Pb can be found from the basic amortizing formula to be

We have

Equivalent uniform monthly payment

=500+equivalent uniform payment step amounts

=500+565.0847

=1065.0847

substituting values, A=1065.0847,i=.05/12,n=60

=56439.591

check: average monthly payment = 1100

duration: 60 months

total amount paid = 60*1100=66000

average annual interest=((66000-56439)/56439-1)/5=3.3% (~ 5%/2) ok.

Amount borrowed,

P=56439.591Step 2: Future value of loan at the end of the 40th month.

This can be found by the compound interest formula

F=P(1+i)^n=56439.591(1+0.05/12)^40=

66652.416Step 3: Future value of payments

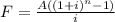

first we need to find the equivalent monthly payment of the step payments, using the same formula as in step 1, but with n=40

=378.924

This should be added to the constant payment of $500 a month to give

A=500+378.924=878.924

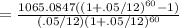

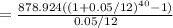

Future value of monthly payment of 878.924

Substitute values, A=878.924, i=0.05/12, n=40

=

38170.213Step 4: Outstanding balance right after the 40th payment

=future value of loan - future value of payments

=

66652.416-38170.213

=

28482.20Answer: Outstanding balance after the 40th payment is $

28482.20