Answer:

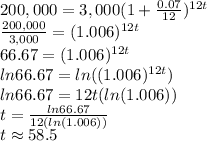

58 months

Explanation:

This is a problem about compound interest, which formula is:

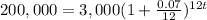

: Future value. ($200,000)

: Future value. ($200,000)

: Present value. ($3,000)

: Present value. ($3,000)

: Annual percentage rate (APR) changed into a decimal. (7%)

: Annual percentage rate (APR) changed into a decimal. (7%)

: Numbers of years. (?)

: Numbers of years. (?)

: Number of compounding periods per year (12)

: Number of compounding periods per year (12)

Replacing all given values into the formula, we have:

Therefore, approximately 58 months to grow the account to $200,000.