Given the two options above, in order to come up with the best plan we have to calculate the future value of money in each plan.

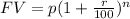

compound interest is given by:

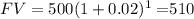

Option 1

p=$500

r=2%=0.02

t=1 year

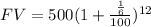

Option 2

p=$500

r=2/12=1/6

n=1*12=12

hence:

=$509.09

Comparing the two plans above, option 1 is the best.

b] Option 1 is the best because she will secure $510 as compared to option 2 which has interest rate that reduces her amount by $1 after one year due to annual charges. The total amount of money she will have at the end of the plan is $510.