Answer:

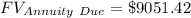

The value of Marina's account in four years is $ 9051.42 .

Option (B) is correct .

Explanation:

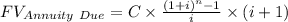

Formula for future value of annuity .

Where C is the cash flow per period , i is the rate of interest and n is the number of payments .

As given

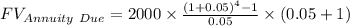

Martina made deposits of $2,000 at the beginning of each year for four years. The rate she earned is 5% annually.

C = $2000

5% is written in the decimal form .

= 0.05

i = 0.05

n = 4

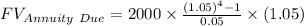

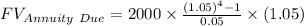

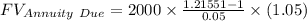

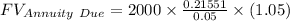

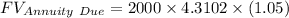

Putting all the values in the above formula

Therefore the value of Marina's account in four years is $ 9051.42 .

Option (B) is correct .