Alice wants to know how much she'll invest today to receive an annuity of $10,000 for six years if interest is earned at 7% annually.

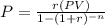

We will use Annuity Payment formula, which states:

where P is the payment,

PV is the present value,

r= rate per period,

n=number of periods.

According to the question,

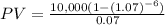

P = $10,000

r=7%

n=6

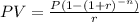

We have to find the present value,

Substituting the values in the given formula,

PV= $ 47,665.

So, Alice wants to invest $47,665 today to receive an annuity of $10,000 for six years if interest is earned at 7% annually.